Free Printable Donation Tracker Template for Tax Season

Key Takeaway (TL;DR)

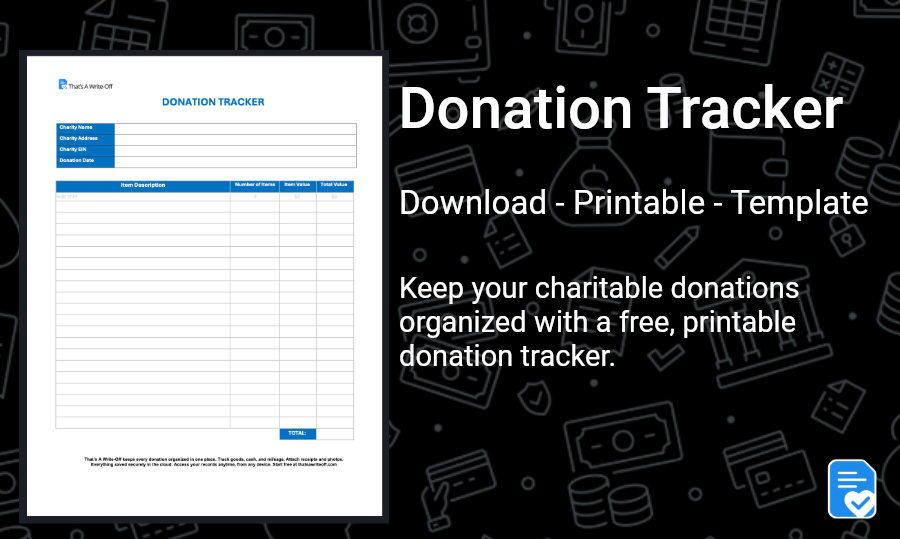

Keep your charitable donations organized with a free, printable donation tracker. This simple tool helps document giving throughout the year so nothing is forgotten during tax season. It’s designed for everyday donors and is available as both a PDF and an editable Word file - no signup required.

- Why It Matters: Most deductions go unclaimed without records. Tracking ensures your donations count at tax time.

- What’s Included: The tracker logs dates, charities, item descriptions, values, and whether a receipt was received.

- Flexible & Simple: Use one sheet per donation or reuse it all year. It’s designed for clarity—nothing extra.

- When Paper Isn’t Enough: Paper works for light use, but digital tools like That’s A Write-Off offer better backup, access, and organization.

- Upgrade When Ready: Start with the printable tracker. Move to cloud-based tracking as your donation activity grows.

Printable Donation Tracker Template (Free Download)

Charitable giving is part of everyday life for many people. Clothes dropped off at a thrift store, cash donations to a nonprofit, or miles driven while volunteering all count as charitable contributions. The challenge is not generosity. The challenge is documentation. Records are often scattered, incomplete, or recreated months later when tax season arrives.

A printable donation tracker helps close that gap. It creates a simple habit of recording donations as they happen. Dates stay accurate. Charity names remain clear. Receipts do not disappear. This free donation tracking template gives you a structured way to capture the details that matter without needing software or an account.

Why Tracking Charitable Donations Matters

Charitable donations only provide tax benefits when they are properly documented. Without records, deductions are often missed or reduced. Many people intend to organize donations later, but waiting introduces errors and forgotten details.

Writing things down at the time of donation takes very little effort. Trying to reconstruct those same details months later can be frustrating and time-consuming. A donation tracker turns good intentions into usable records.

What This Donation Tracking Template Includes

Designed for Common Donation Types

This template is built for everyday donors. It supports cash donations, non-cash goods such as clothing or household items, and mileage driven for charitable purposes. Each entry provides space for the donation date, charity name, description, and value, along with a place to note whether a receipt was received.

Simple and Reusable Format

The layout is intentionally straightforward. You can use one sheet per donation or maintain a running log across multiple pages. Many people store these pages with other tax documents so everything stays in one place throughout the year.

Download the Free Donation Tracker

The donation tracker is available as both a printable PDF and an editable Word document. The PDF works well for handwriting entries. The Word version allows you to type or customize the layout to match your preferences.

No account is required. Download, print, and start tracking immediately.

The Limits of Paper Donation Tracking

Paper tracking works best when donation activity is minimal. As donations increase, limitations become clear. Pages accumulate. Receipts must be manually attached. Fair market values are often estimated without reference material. Access is also limited since paper records exist in only one location.

These issues usually surface during tax preparation, when time matters most.

A More Organized Way to Track Donations

- Moving Beyond Paper - That’s A Write-Off takes the same information captured on paper and stores it securely online. Donations are logged as they happen. Receipts are uploaded and attached directly to each record. Everything is saved in the cloud.

- Why Cloud Storage Helps - Cloud storage means records are backed up automatically and accessible from any device. Past years remain available. Reports are ready when needed. Nothing needs to be reconstructed from memory.

Many people start with a printable donation tracker and move to an online system once they see how much time consistent tracking saves.

Start Simple. Upgrade When Ready

This printable donation tracker is a practical way to begin tracking charitable contributions today. When you are ready for a more complete system, you can start for free with That’s A Write-Off at thatsawriteoff.com/signup.

Track donations once. Stay organized every year.

Not tax advice.

This article provides general educational information only. It does not consider your personal tax situation. For guidance specific to your circumstances, consult a qualified tax professional. Tax laws and IRS rules change, and outcomes depend on individual facts.

Make Donation Tracking Easy

Log what you give, when you give it, and who you give it to. Stay ready for tax season all year.